COINBASE DEVELOPER PLATFORM

Tools to bring the world onchain

Trusted, scaled, and reliable developer tooling to power your vision from initial concept to global adoption.

Trusted by the most ambitious builders

Coinbase Developer Platform gives builders the most trusted, scaled, and reliable onramps and infrastructure available for building onchain apps.

We built these products and services to use ourselves, and now we’re sharing them with builders.

Leverage our APIs and infra, so you can focus on building your product.

Our products scale as your organization, strategy, and products grow.

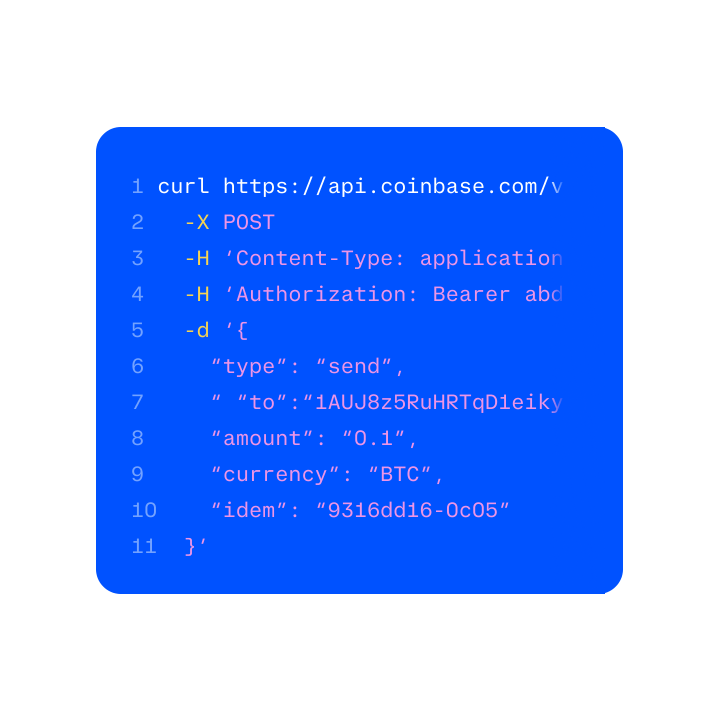

Utilize our Product APIs

Automate trades programmatically

Place orders and track market data

Trade, provide custody, and manage assets

Accept crypto payments

Enables users to log in with Coinbase

Let users access your dapp with Wallet

Base

Base is a secure, low-cost, builder-friendly Ethereum L2 built to bring the next billion users onchain.

Secure staking across 15+ networks

Leverage our decade of crypto experience to provide end users with reliable staking solutions. We serve security-minded custodians, exchanges, fintechs, dapps, and wallets on Ethereum, Solana, and many other protocols. Our staking infrastructure is meticulously designed to prioritize the safety and security of client assets, as evidenced by our industry-leading performance track record.

Building onchain is hard. We make it easy.

We're committed to helping builders create incredible products. That’s why we’ve made it easy to access powerful APIs and SDKs from Coinbase to help solve developers’ toughest problems.

Discover

Read about the latest developer news, insights, and resources.

Contact us

Are you an enterprise business looking to learn more or talk with our team? Get in touch.